So, you’ve been working on your innovative IT idea and have started thinking about raising capital to take it to the text level. There several things to consider when raising capital, some are quite obvious while others require a bit more research. It terms of the obvious, consider first applying your own sweat equity and using some of your own capital to bootstrap the development. This will increase your stake in the game, the future share in the company, and will send your new potential investors an important message that you believe in your idea and have made financial commitment. That is a strong position to be in before starting to seek further capital.

Ask yourself why?

First, ask yourself a simple question before starting to look for capital: “Why do you need the capital?” Frankly, in many situations you may either not need outside capital right away since more work can be done in-house, or that your product or service is not ready for investment. If you can’t answer the “why” question fully, take a moment and jot down your thoughts and include as much detail as possible. Use that information to build your business case which will be useful and required by different types of investors.

When is the best time?

Timing for raising capital, like with many other things in life and business, is important. While writing your business case, you should deeply ponder if the product or service that you innovated, invented, or built as a prototype or alpha version is at a stage in which it is presentable and relatable so that others can actually understand it, see its potential use and value, and be willing to pay for it. If you are at that stage, and have exhausted your own resources, the timing may be right to ask for additional capital.

Who to ask, and “who are you”?

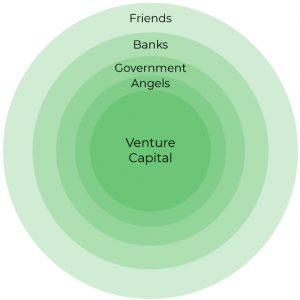

There is no shortage of whom to ask for capital. Think of this process as an “onion” that you peel a layer at a time as in the figure below. The first, and most outer layer, has all your friends and relatives, and perhaps even colleagues who wish to join your venture for sweat equity or financial contribution. The second includes banks as they provide loans and lines of credit to small businesses at reasonable rates.

Where is the money?

In Canada, many of the larger cities host VCs, with Toronto leading the pack, followed by Montreal and Vancouver, and the Waterloo area. Canada’s east coast has also seen a rise of startups and should not be overlooked. In the USA, consider San Francisco, New York, Boston, and Seatle, just to mention a few, as many other cities that are also seeing a rise in VC funding. Some, as an IT startup, look local first, and then branch out if needed. The following links are useful to get started in your research:

| CANADA | National Angel Capital Organization Canadian Venture Capital |

| USA | Angel Investment Network National Venture Capital Association |

How to start?

There is no one answer for all IT startups on how to best start looking for angel and venture capital. A good course of action would be to first do some basic research to find out who are the local players. Then, connect with a few local angels and VCs through direct channels, social networks, and local incubators / accelerators. Get to be known the people who are leading those organizations in terms of their values and investment philosophy. Aim for a more personable approach to connect with them since it will make a difference when you actually submit your slide deck for funding consideration.

In conclusion

Before seeking external investment capital, ensure that you have sufficiently invested your own sweat equity and personal financing to build your demo-ready product or service that is backed with a good business case. Check if your venture is relatable so that investors can clearly see its value and application. Such due diligence is essential so that you don’t waste your time and the time of investors who are inundated with venture proposals. With a wide range of investors available, do your research to strategically choose your investors based on commonly shared values. Strive to create a positive business and personal connection at each step of the way which in turn will make a difference when you make your pitch.

About the Author

Dr. Predrag Pešikan an electrical engineer and business professional with management and leadership experience in both public and private higher education sector. He has served in executive roles as CIO, VP-IT, and Dean, and recently led the development of industry relevant programs including AI, Cybersecurity, and IoT. His research interest is in IT, leadership, and profitability of tech startups.

Follow Predrag on LinkedIn